Venture investments in Europe have witnessed significant growth in recent years, yet they are not without their hurdles. This article delves into the challenges faced by European venture investments in scaling their operations, overcoming barriers to expansion, and navigating the complexities of growth in a dynamic market landscape.

Navigating the Landscape of European Venture Investments

Understanding European Venture Investments: Europe has emerged as a thriving hub for venture capital, with diverse sectors and innovative startups attracting investors from around the globe. However, expanding operations in this competitive market presents its own set of challenges.

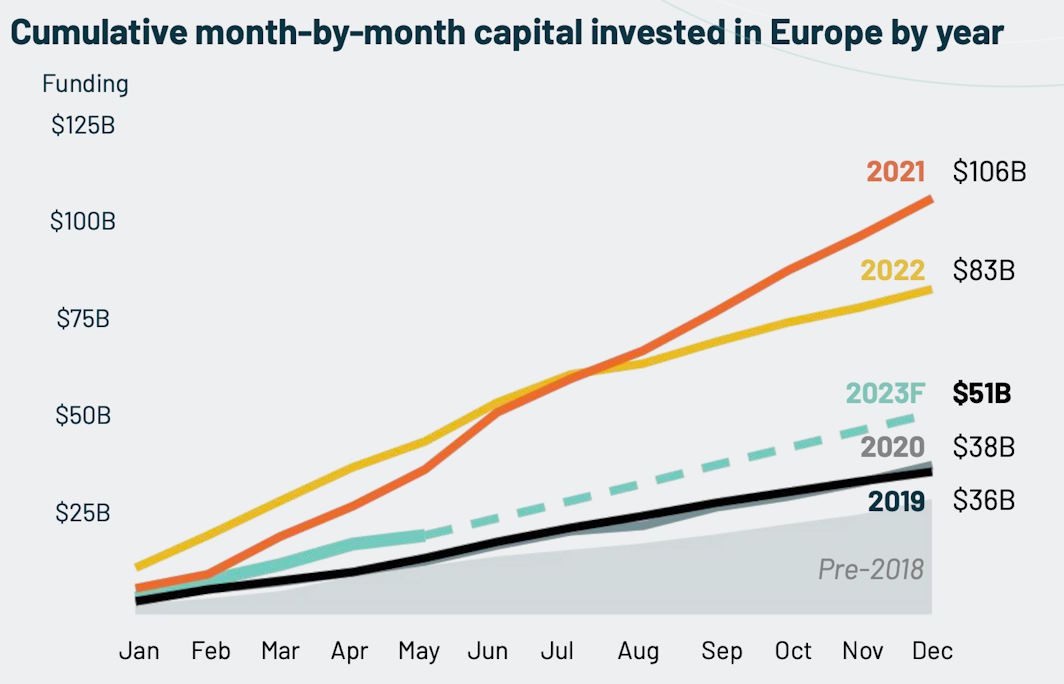

The Growth Trajectory: Despite the challenges, European venture investments have experienced remarkable growth, driven by technological advancements, supportive regulatory frameworks, and a vibrant startup ecosystem. However, sustaining this growth and scaling operations pose significant hurdles.

Hurdles of Expanding European Venture Investments

Regulatory Complexity: Navigating diverse regulatory environments across European countries can be challenging for venture investors, requiring a deep understanding of local laws, tax structures, and compliance requirements.

Fragmented Market Dynamics: Europe’s fragmented market landscape presents challenges in scaling operations across borders. Varying cultural norms, languages, and business practices add layers of complexity for investors seeking to expand their presence in multiple countries.

Access to Talent and Resources: While Europe boasts a rich pool of talent and resources, accessing the right skills and expertise can be a hurdle for growing venture investments. Competition for top talent, particularly in specialized fields such as technology and biotech, adds pressure to recruitment efforts.

Overcoming Barriers to Expansion in European Venture Investments

Strategic Partnerships and Alliances: Forming strategic partnerships and alliances with local stakeholders, including startups, corporates, and government entities, can facilitate market entry and expansion. Collaborative initiatives help navigate regulatory complexities and access local networks and resources.

Investor Education and Awareness: Educating investors about the opportunities and challenges of European venture investments is crucial for fostering confidence and attracting capital. Increasing awareness about the region’s potential, market dynamics, and investment opportunities can help overcome barriers to expansion.

Dealing with the Difficulties of Scaling European Venture Capital

Operational Efficiency and Scalability: Scaling European venture capital operations requires a focus on operational efficiency and scalability. Streamlining processes, leveraging technology, and investing in robust infrastructure are essential for managing growth effectively.

Talent Development and Retention: Prioritizing talent development and retention strategies is key to sustaining growth in European venture investments. Providing ongoing training, mentorship, and career development opportunities can attract top talent and foster a culture of innovation and collaboration.

In conclusion, while European venture investments offer abundant opportunities for growth and innovation, they are not without their challenges. Navigating regulatory complexities, market fragmentation, and talent acquisition hurdles requires strategic planning, collaboration, and a deep understanding of local dynamics. By overcoming these barriers and embracing change, European venture investments can continue to thrive and shape the future of the global startup ecosystem.